DRIVE GROWTH AND RETENTION WITH A COMPLETE VIEW OF YOUR CUSTOMER’S PROFITABILITY Discover Customer Profitability and Strengthen Relationships with 360 View

Gain transparency throughout your financial institution

Understanding your customers' true value is key to building strong relationships. With 360 View, your team gains a transparent view of account-level and household-level profitability, enabling data-driven strategies that drive growth.

Key Benefits

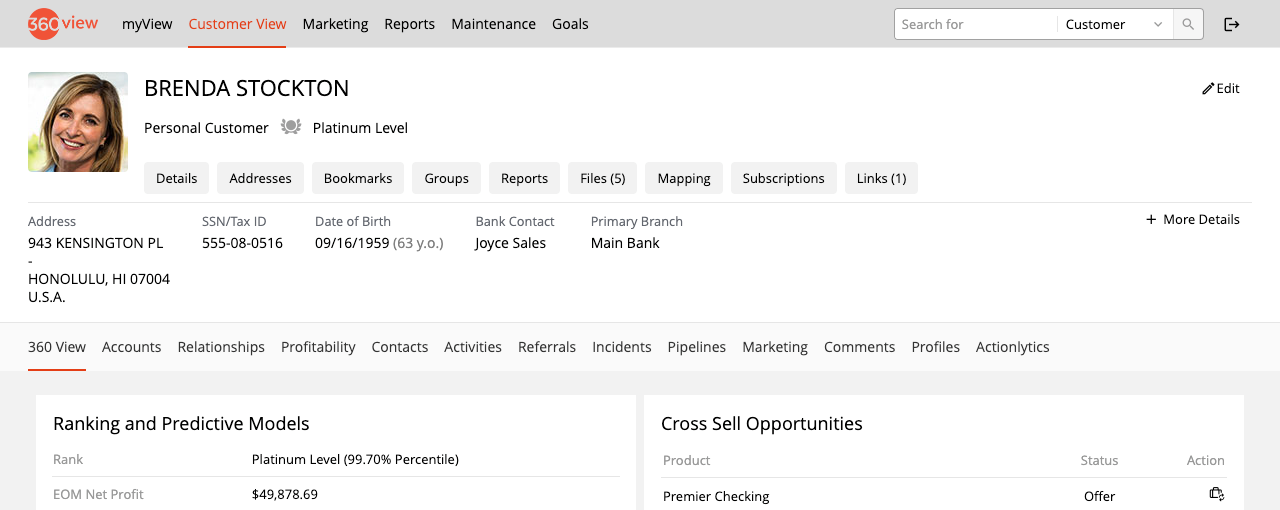

Profitability Insights

With profitability insights, your institution can access up-to-date profitability data at the click of a button. This feature provides a comprehensive view of account performance by delivering month-to-date profitability statements and tracking trends over time. By having access to timely metrics, banks and credit unions can make more informed, data-driven decisions, ensuring resources are allocated efficiently to the most profitable accounts. This insight helps identify immediate opportunities for retention and growth, empowering your institution to react quickly to changing market conditions or customer behavior.

Customer Ranking & Trends

Customer ranking and trends enables your institution to gain a clear understanding of customer value, both currently and historically. By identifying top customers and monitoring their value over time, you can segment clients based on profitability, loyalty, and engagement. This data helps you recognize high-value clients who may require more personalized services, while also pinpointing at-risk accounts. With this insight, banks and credit unions can proactively develop and implement tailored retention strategies—such as targeted promotions, loyalty rewards, or specialized offerings—to strengthen relationships and reduce churn.

True Account Profitability

True account profitability takes profitability to the next level by going beyond just account balances and transactional data. This feature factors in both hard costs (e.g., operational expenses, maintenance costs) and soft costs (e.g., customer service interaction, marketing efforts) that are specific to your institution’s operations. By providing a more nuanced and comprehensive profitability calculation, you can truly understand the financial health of each account. This empowers your institution to identify areas where costs can be optimized and where strategic investments should be made to maximize profitability.

Growth Strategies for Unprofitable Customers

By using detailed profitability data, you can identify customers who may be unprofitable to your institution. Instead of simply abandoning or downgrading these relationships, banks and credit unions can implement targeted strategies—such as adjusting fees, providing educational resources, or introducing new products—to increase engagement and profitability over time. This data-driven approach turns unprofitable customers into long-term, loyal clients, increasing overall customer lifetime value.

Complete Transparency

Having complete transparency allows for deep insights into every calculation behind your profitability reports, helping you understand how your financial data is derived. This includes detailed breakdowns of funds transfer pricing (FTP), which allows your institution to see exactly how internal pricing mechanisms, interest rates, and internal cost structures are impacting profitability. Having this level of transparency builds trust in your financial analysis and ensures that your decisions are based on accurate, reliable data. It also provides the confidence needed for stakeholders to make strategic decisions with full visibility into the true costs of doing business.

Create a performance-driven culture where employees are empowered to achieve more

The 360 View platform has given us the profitability insight we needed to make real, positive change within our organization. Not only that, but we have gained numerous efficiencies that have allowed our employees to get more customer focused time back in their days.

Learn more about Profitability

Our Suite of CRM Products to Build Better Customer Relationships

We customize our suite of products to design a unique solution for your financial institution.

Set Your Bank or Credit Union Up for Success

You’ll need the right software and team supporting you to reach the next level of service. Let’s connect!